2023 YEAR END and 2024

1st QUARTER Reportorial Requirements

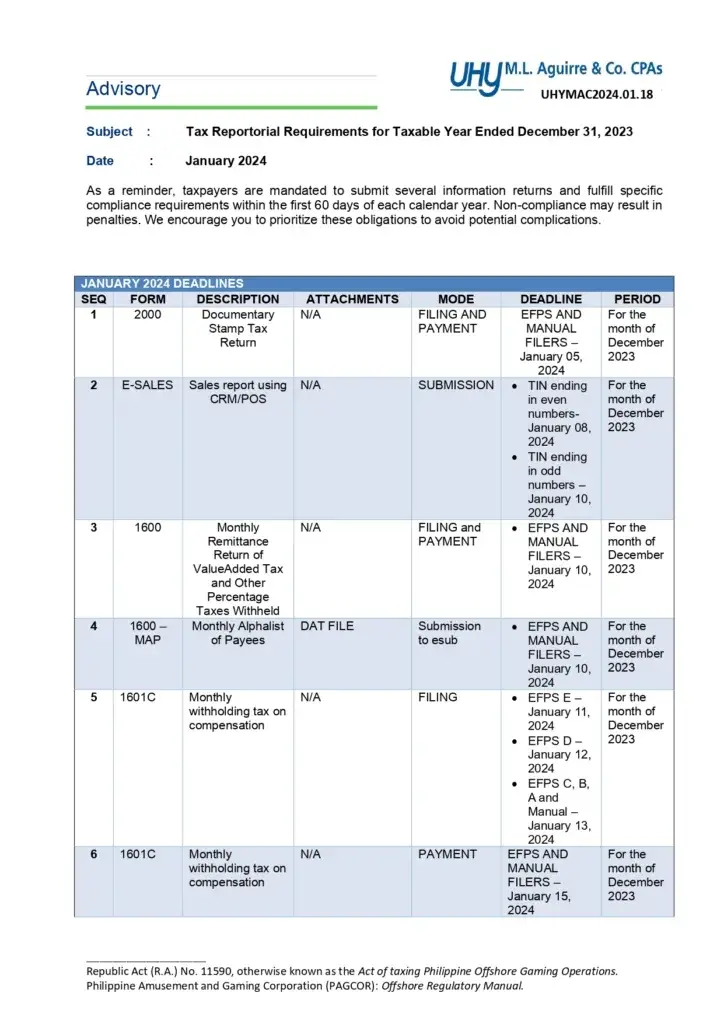

A number of information returns and other compliance requirements for taxpayers in the first ninety (90) days or so of every year are mandated to be submitted. There are relative penalties imposed on non-compliance.

We are issuing this reminder to ensure our compliance and to avoid any unwanted fines and penalties.

Fill out the form below to get a copy of our this file.

Let’s get moving.

What’s in it for you if you avail T.A.X. Satori?

- Gain valuable insights into tax planning

- Ensure compliance with tax regulations

- Maximize your tax savings

- Connect with experienced tax specialists and accountants for expert advice and strategies to navigate taxation complexities

Interested to learn more about T.A.X. Satori & our consulting services? Book a call now!