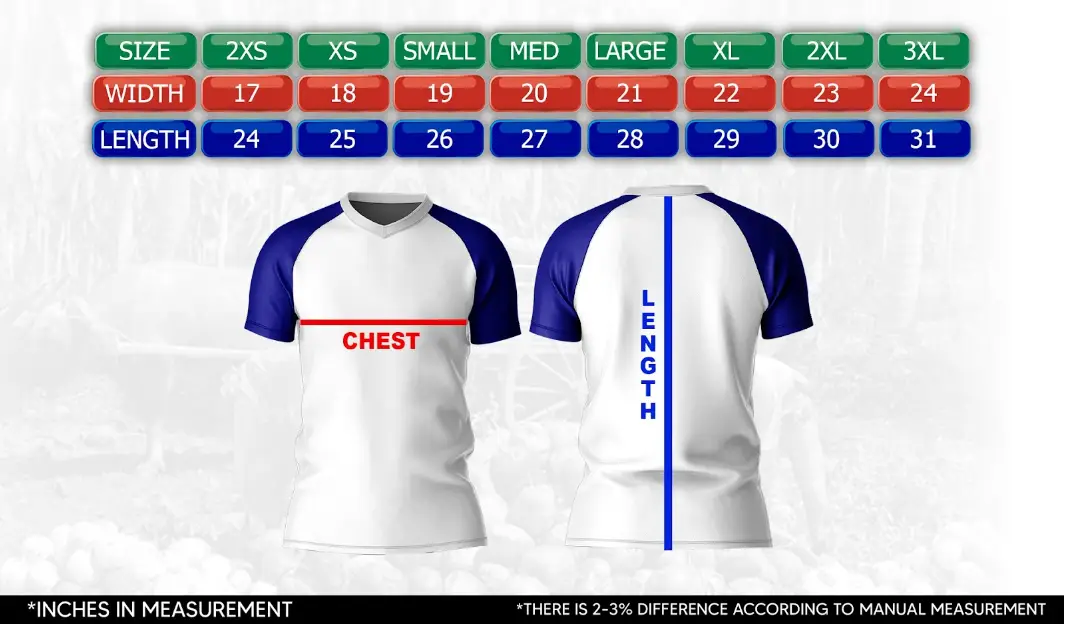

Clearing the Slate: Tax Amnesty until July 5, 2026 under the RPVARA Law (RA No. 12001)

Republic Act No. 12001, otherwise known as the Real Property Valuation and Assessment Reform Act (RPVARA), institutionalizes a unified, fair, and equitable real property valuation system in the Philippines. As a transition measure, the law provides for a Tax Amnesty Program to encourage taxpayers to settle outstanding real property tax (RPT) liabilities and clean up […]

Tax Implications and Incentives Under the Electric Vehicle Industry Development Act (EVIDA)

What is the Electric Vehicle Industry Development Act? The Electric Vehicle Industry Development Act (EVIDA) establishes a comprehensive incentive framework to accelerate the growth of the electric vehicle (EV) industry in the Philippines. The law grants a mix of fiscal incentives—such as eligibility for investment promotion incentives, duty exemptions on EV charging infrastructure, and discounts […]

EXPORT-ORIENTED ENTERPRISES IN THE PHILIPPINES: A Post-CREATE MORE Law Framework

The CREATE MORE Law (RA 12066) modernizes the Philippine incentive framework for Export-Oriented Enterprises (EOEs) by redefining EOEs as businesses exporting at least 70% of their output and shifting incentives toward performance-based criteria. It expands VAT zero-rating on local purchases and VAT exemption on imports, allowing EOEs to continue enjoying these benefits even after Investment […]

The Audit Reset: How the BIR Is Changing the Way It Conducts Tax Audits

After months of uncertainty, the Bureau of Internal Revenue (BIR) has formally reopened the doors to tax audits, but not without promising that the system taxpayers return to will be markedly different from the one that was put on hold. Through Revenue Memorandum Circular (RMC) No. 008-2026 and Revenue Memorandum Order (RMO) No. 1-2026, both […]

Tis the Season to Save: A Tax Advisory on the Amended ‘De Minimis’ Benefits Ceiling

Season’s greetings from the Tax Department! As we wrap up the year, we bring you a gift of good news that could boost your year-end tax planning—an update on the “De Minimis” Benefits provisions! The latest amendment to Revenue Regulations (RR) No. 2-98, as amended, increases the ceiling for non-taxable benefits. Whether you’re an employer […]

BIR Implements Temporary Suspension of its Enforcement Activities

In light of recent public sentiment about numerous complaints from taxpayers about irregularities and inconsistencies within the Bureau of Internal Revenue (BIR), the agency has issued Revenue Memorandum Circular (RMC) No. 107-2025 to address growing concerns regarding the integrity and transparency of its enforcement activities. The circular implements the temporary suspension of all audit and […]

PEZA M.C. 2025-051 adopts standardized CETI format

PEZA issues M.C. 2025-052 to clarify VAT Zero-Rating for Goods & Services

Philippine Economic Zone Authority Memorandum Circular No. 2025-052 turns the CREATE MORE Act’s broad VAT promises into a working playbook: it defines what counts as “directly attributable” to a registered project or activity and, therefore, qualifies for VAT exemption on importation and VAT zero-rating on local purchases for PEZA-registered export and high-value domestic market enterprises. […]