Season’s greetings from the Tax Department!

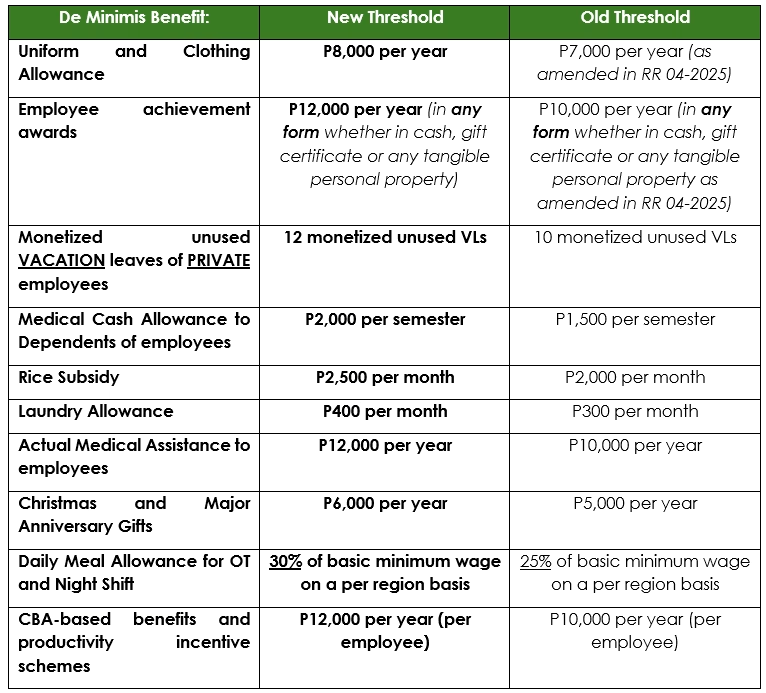

As we wrap up the year, we bring you a gift of good news that could boost your year-end tax planning—an update on the “De Minimis” Benefits provisions! The latest amendment to Revenue Regulations (RR) No. 2-98, as amended, increases the ceiling for non-taxable benefits.

Whether you’re an employer planning your holiday bonuses or an employee looking forward to some festive perks, this amendment is the perfect addition to your tax checklist this season.

Here’s how this change can brighten your holidays.

What does RR 29-2025 pertain to?

RR No. 29-2025 further amends RR No. 2-98, as amended by RR No. 004-2025, specifically concerning “De Minimis” benefits, which are exempt from both income tax on compensation and fringe benefit tax.

Threshold Changes

Key Takeaway

This holiday season presents a wonderful opportunity to take advantage of the increased “De Minimis” benefits thresholds, allowing both employers and employees to enjoy greater tax savings. It’s the perfect time to reflect on your year-end tax planning and make the most of these updated provisions, ensuring a festive and financially savvy holiday season. As we embrace the joys of Christmas and the new year ahead, may this festive time be filled with peace, prosperity, and well-planned taxes. Wishing you a joyous and merry Christmas—let’s make the most of this season together!

Article Written By:

Kyle Clarence L. Williams, Rhea Pelayo, Chriztel Joy Manansala

Tax Department

Found this helpful? ♻️ Share and follow Babylon2K & UHY M.L. Aguirre & Co., CPAs for more.

P.S. Powered by #BethAI – ai.babylon2k.org, your intelligent assistant for tax, audit, accounting, and licensing.