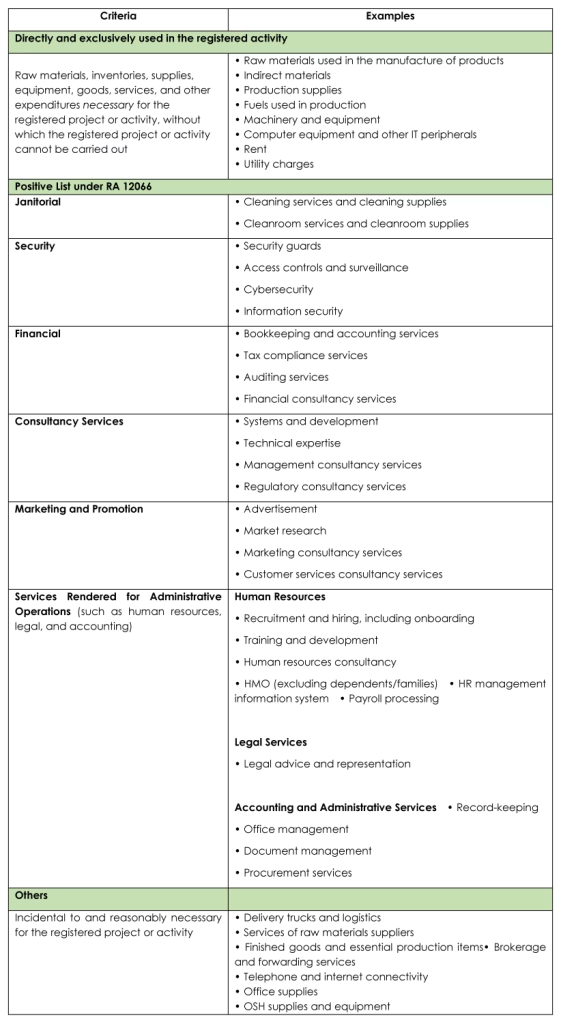

Philippine Economic Zone Authority Memorandum Circular No. 2025-052 turns the CREATE MORE Act’s broad VAT promises into a working playbook: it defines what counts as “directly attributable” to a registered project or activity and, therefore, qualifies for VAT exemption on importation and VAT zero-rating on local purchases for PEZA-registered export and high-value domestic market enterprises. Read it as an attribution test, not a vendor list—covering inputs that are incidental to and reasonably necessary for operations, from janitorial and security to financial, consultancy, marketing/promotion, and administrative services like HR, legal, and accounting. Crucially, the Circular confirms that the Investment Promotion Agency (IPA)—for locators, PEZA—has determinative authority on attribution and eligibility, anchoring documentation, invoicing, and audit-defensible compliance on a transaction-by-transaction basis.

What’s in it as a “directly attributable” purchase of goods and/or services?

PEZA has clarified when VAT exemption on importation and VAT zero-rating on local purchases apply to goods and services directly attributable to a registered project/activity of PEZA-registered export and High Valued Domestic Market Enterprises.

The assessment of whether a particular procurement qualifies as being directly attributable to the registered project or activity of a registered business enterprise shall be subject to the evaluation and judgment of the relevant IPA.

We have to take note that the list isn’t exhaustive. If a registered business enterprise (RBE) buys local goods or services not explicitly listed but believes they are directly attributable or incidental and reasonably necessary to its registered project or activity, it may request PEZA confirmation.

What to submit to PEZA for confirmation:

- Company letter on official letterhead, signed by the highest responsible officer, explaining why the goods/services are directly attributable to the registered activity and attaching supporting documents (e.g., contracts/POs, scopes of work, allocation workings, proof of use).

- Notarized Sworn Affidavit attesting to direct attribution, using PEZA’s prescribed template (ERD.2.F.008).

- Important reminder: PEZA’s confirmation does not limit BIR’s authority. The BIR may still conduct post-audit verification to confirm that the purchases are truly directly attributable to the RBE’s registered project or activity.

Key Takeaway

VAT zero-rating under PEZA MC 2025-052 is an attribution test—each purchase must be defensibly “directly attributable” to the registered activity, with PEZA as the arbiter and BIR able to audit after the fact; how strong is your transaction-level documentation trail today?

Reference:

PEZA Memorandum Circular 2025-052

Article written by:

Kyle Clarence L. Williams, CPA, MICB, RCA, CAT; Chriztel Joy Manansala, CPA; Rhea Pelayo