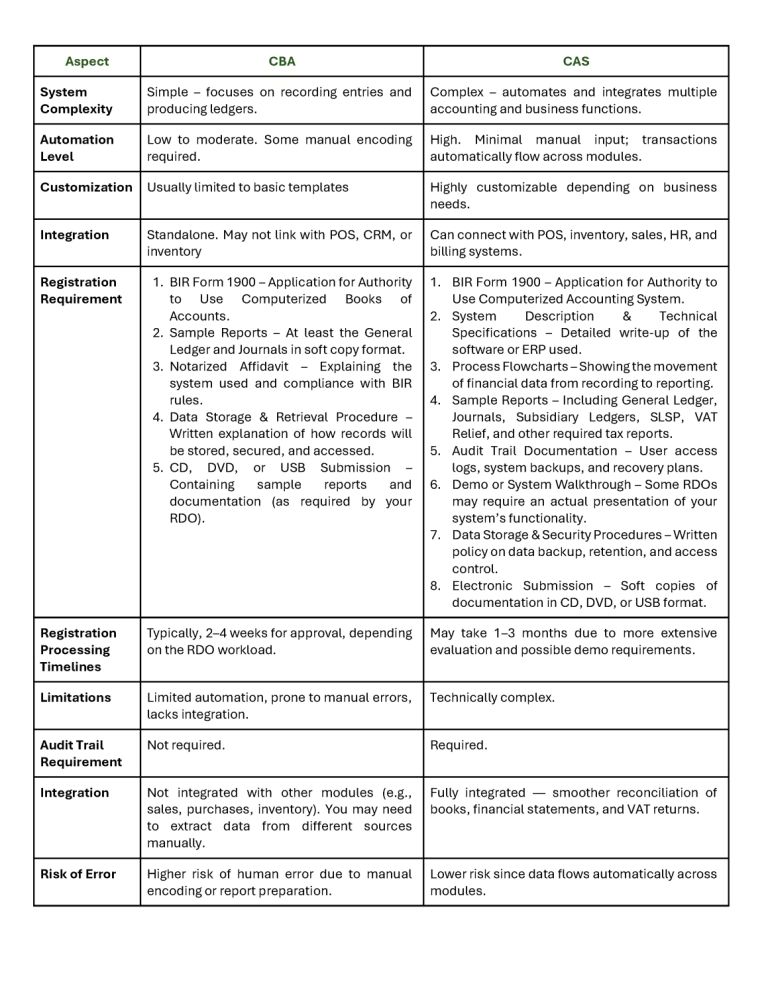

As more businesses in the Philippines move toward digital recordkeeping, one common question arises: Should you register your system with the Bureau of Internal Revenue (BIR) as a Computerized Books of Accounts (CBA) or as a Computerized Accounting System (CAS)?

Both are recognized by the BIR for maintaining electronic accounting records, but they differ in their purpose, complexity, and compliance requirements. Understanding these differences can help businesses determine which option best fits their operations.

Understanding the Difference Between CBA and CAS

Choosing Between CBA and CAS

Your choice depends on the nature and complexity of your operations:

- CBA is ideal for small to medium-sized enterprises (SMEs) with straightforward transactions and no fully integrated ERP system. It’s easier to manage and quicker to register but offers limited automation.

- CAS is best suited for larger enterprises using integrated accounting or ERP systems that consolidate sales, purchases, inventory, and tax reporting. It requires more documentation but supports better accuracy, efficiency, and scalability.

Article written by: Chriztel Joy Manansala, CPA and Kyle Clarence L. Williams, CPA, MICB, RCA, CAT

Sources: BIR Revenue Memorandum Circular No. 5-2021; BIR Revenue Memorandum Order 9-2021

Found this helpful? Share and follow Babylon2K & UHY M.L. Aguirre & Co., CPAs on LinkedIn to stay updated..

P.S. Powered by #BethAI – ai.babylon2k.org, your intelligent assistant for tax, audit, accounting, and licensing.